In an ongoing effort to ensure the smooth implementation of GST Reforms 2.0, the State Taxes Department has intensified its public awareness and market surveillance drive across all districts of Kashmir.

As part of the initiative, circle offices of the department, in coordination with enforcement wings in North, South, and Central Kashmir, conducted inspections at various business establishments. Alongside enforcement, officials also launched awareness campaigns to educate consumers about the new GST structure and its expected benefits.

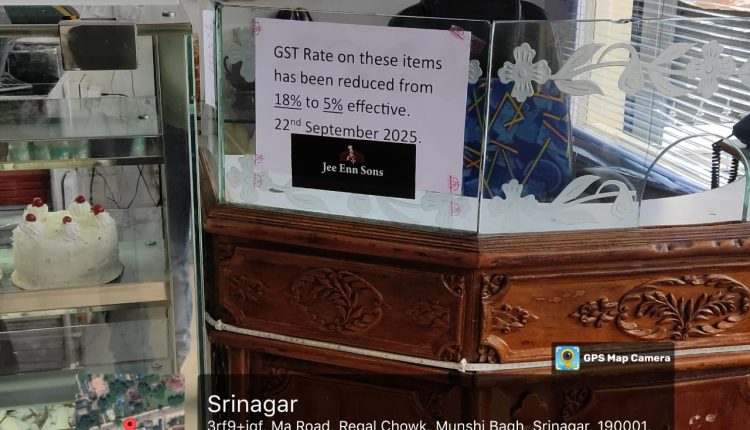

The inspections focused on assessing compliance with the updated GST regulations, urging businesses to adhere strictly to the revised framework. During the awareness outreach, officials highlighted the potential relief for consumers, particularly regarding reduced prices on daily-use items.

Under GST Reforms 2.0, the earlier four-tier tax structure—5%, 12%, 18%, and 28% has been replaced by a simplified two-tier system of 5% and 18%. This rationalization is projected to lower the cost of nearly 99% of essential items, offering substantial relief to the general public.

The State Taxes Department, under the leadership of the Commissioner, reiterated its commitment to transparent, fair, and effective implementation of the reforms.

While business establishments have been urged to ensure full compliance, the public is encouraged to stay informed and take advantage of the consumer-friendly changes introduced under GST Reforms 2.0.

Comments are closed.